Nearly everyone’s excited about the incoming $MET airdrop. And that’s because it is shaping up to be one of the biggest events of Q4 for Solana. Especially considering the role the liquidity provider and support infrastructure plays in the ecosystem.

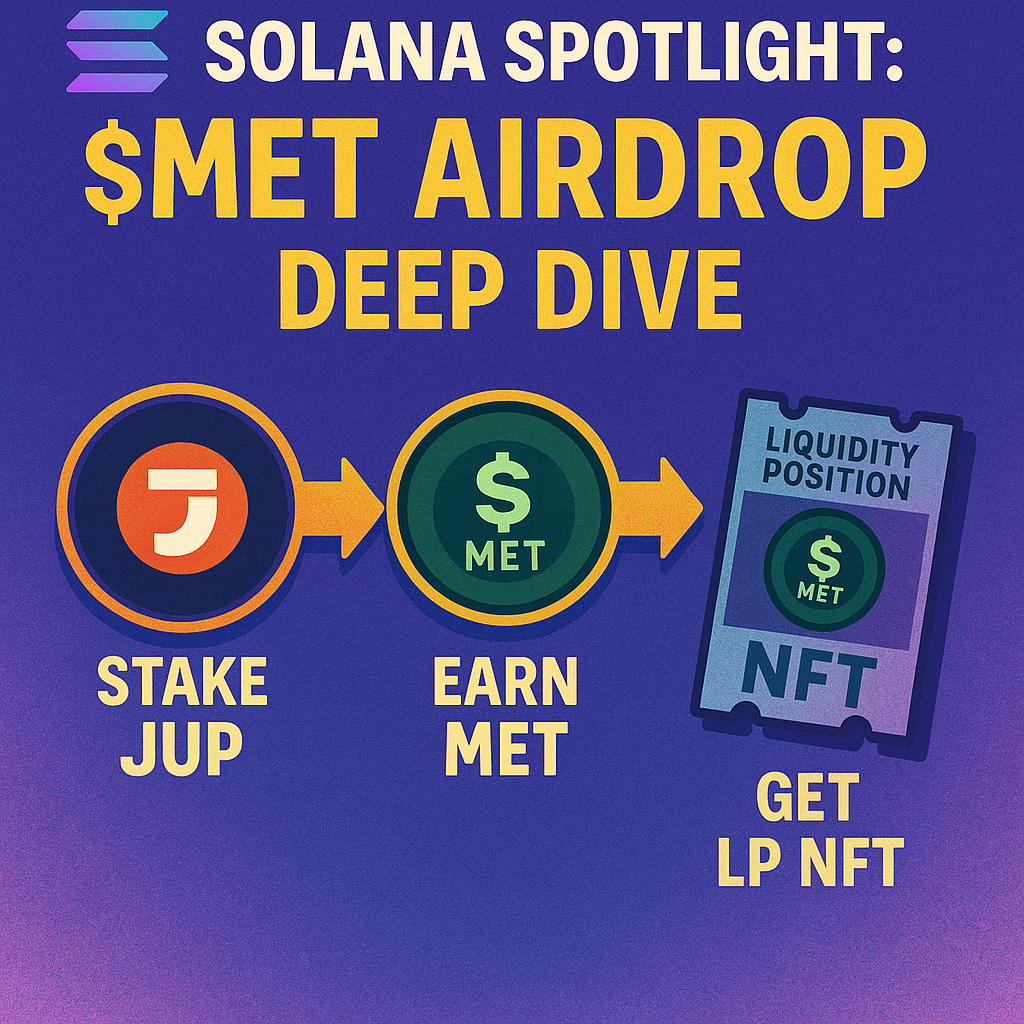

So what we’ve learnt is that Meteora has confirmed that JUP stakers are eligible for the airdrop, with details being worked out. Plus the buzz around governance proposals, point systems, and liquidity NFTs is pushing traders to front-run strategies before the Token Generation Event (TGE) hits in October.

Here’s the rundown — what’s confirmed, what’s still fuzzy, and how to position for upside without falling into the hype trap.

1. Confirmed: JUP Stakers Are In

- Meteora announced that Jupiter (JUP) stakers will qualify for the airdrop.

- A draft proposal sets aside 3% of the TGE reserve for distribution to JUP stakers. 0xSoju pretty much released a post containing more suggestions about how to handle this literally minutes from the writing of this post.

- Rewards won’t just be raw tokens — they’ll come as Liquidity Position NFTs tied to MET/USDC pools, designed to provide liquidity at launch instead of fueling immediate dumps.

2. Points & Farming System – Season 1 vs. Season 2

- Season 1: Ended June 30, 2025. Points were earned from TVL + trading fees. A snapshot has already been taken, and a checker tool is live for participants.

- Season 2: The rules changed. Only trading-fee activity counts for points now, with TVL stripped out. Farmers are shifting to high-volume pools to maximize accrual.

Takeaway: The points grind isn’t over — but Season 2 rewards activity, not just idle deposits. So you’ll have to work for your airdrop, maybe even try to get that LP army role finally eh?

3. The Unknowns (Trader Risks)

- Snapshot Timing: Outside of June 30 for Season 1, exact JUP snapshot dates aren’t locked. So you should stay staked to avoid missing eligibility.

- Minimums & Weights: Drafts hint at time-weighted stakes and governance participation, but thresholds are still not finalized. Like I said earlier, 0xSoju’s pay post reveals how much of everything still isn’t finalized yet.

- NFT Mechanics: When and how LP NFTs unlock into tradable $MET remains unclear. Vesting vs. instant liquidity could affect sell pressure.

- FDV & Circulation: Market odds peg $MET’s FDV between $1–2B, but allocations for team/foundation aren’t yet public.

4. Trading Angles & Strategies

- Stake & Stay: JUP stakers who remain locked through governance cycles are best positioned for the 3% allocation.

- Farm Fees, Not TVL: With Season 2 focused on fee generation, concentrate capital in high-volume pairs to stack points.

- Governance Play: Participate in Meteora proposals — voting history could tilt eligibility in your favor.

- Hedge With Markets: Polymarket odds (95% > $1B FDV) let you hedge expectations while farming for allocation.

- Watch LP Unlocks: The liquidity NFT format means volatility will hinge on how/when tokens unbundle into circulating supply.

🚀 Bottom Line

The $MET airdrop isn’t just another freebie — it’s a test case for how Solana projects can blend staking, liquidity, and governance into one mechanism. For traders, the alpha is simple:

- Stake JUP and keep it staked.

- Focus on fee farming, not idle TVL.

- Position ahead of TGE liquidity dynamics.

When October hits, $MET could be the spark that turns farming grind into one of Solana’s largest liquidity events of the year and the next.

So a question to readers: will you be grinding for $MET?

Leave a Reply