You still here, anon?

By now the bear should be over, right? Right?

That’s what every trader thinks, i’ll bet. And while that might be our wishes, sometimes it doesn’t help to just blindly believe price action will get back to normal. In times like these, analysis can go a long way into preparing one for the inevitable rise.

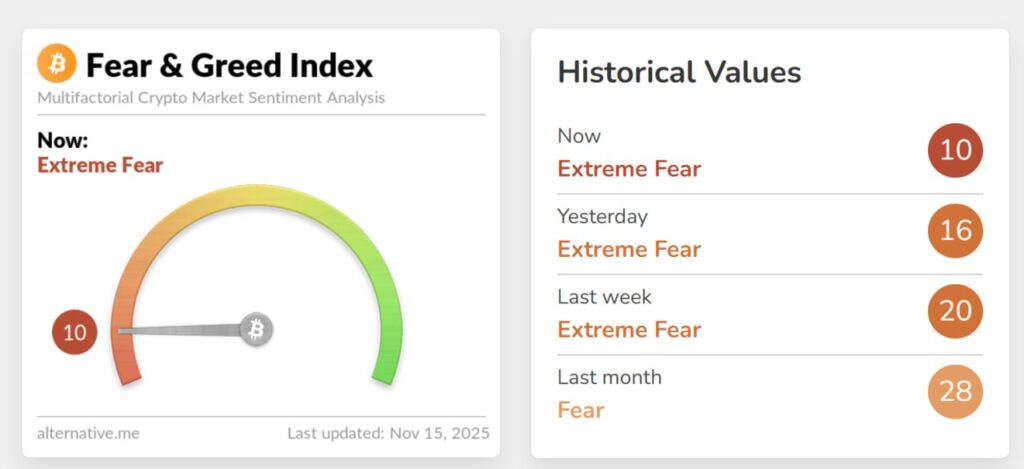

With that in mind, knowing key factors like the Fear and Greed Index, and whether a coin is currently overdue for a retracement are very invaluable tools in a trader’s arsenal.

The Fear and Greed Index:

This meter helps determine the general situation and level of sentiment when it comes to crypto in general. Fear as in FUD and extreme selling, and Greed as in FOMO and euphoria.

Fear levels mean people are selling and panic might be setting in, while greed always indicates a lot of buying to avoid missing out on gains. As of yesterday, they were at 10, the lowest i’ve ever seen before.

So while the fear is in and the market is red, it might be good to look for tokens that might potentially be ready to bounce and confirm their charts using our new web terminal.

But first, how would you go about knowing what to buy? Maybe by buying something that will stop being shorted so much soon. (Yeah, like you haven’t already thought of that.)

Anyways, let me introduce you to a little something called the RSI.

The Relative Strength Index:

https://www.coinglass.com/pro/i/RsiHeatMap

The RSI is a technical analysis tool that measures the speed and magnitude of price changes to identify overbought or oversold conditions in a security. Security here would normally extend to tokens, and while you may think that SolCypher only caters to memes, you would be wrong. (Have you seen our new terminal?)

Well, with this tool and especially the link up here, you can see tokens that are currently in regions that can safely be said to be overbought (meaning they could be due for a retracement) and oversold (you could make some money over a time period by buying them) respectively.

Making that decision to buy will still be yours to make, but at least these two factors should help influence your charting sessions on the terminal.

With that in mind, a few things are also important in times like these and they include but are not limited:

- Fundamental Research/Analysis (Also known as DYOR): All you need to do this is to do your solid research on the token or product, find out what’s important and why you think the project has an edge. If it’s something like Solana, then remind yourself of all the things that make it a good buy in a bear market and then decide if you will hold or do something else.

- Take stock of personal finances: Crypto is only healthy as long as it doesn’t make your real life suffer. So if holding or buying will hurt you in the real world, always prioritize yourself first. There will always be an opportunity, they say.

- Dollar Cost Averaging: You’ve heard about the dip that keeps on dipping, right? Well, you could say it’s a gift that keeps on giving. xD. In any case, DCA allows you to at least prepare against a further possible dip, allowing you to spread an amount across a price range and acquire more than you usually would.

- Stabling: Holding a portion of your assets in stablecoins is something that is usually advocated for and could help as well.

What do you think? Was this helpful, and do you have a strategy that works for you in times like this?

Leave a Reply