Will that distract you from the charts until we get back to comfortable levels, my dear Cypher?

We hope it does, especially as this one is a piece of alpha shared with you once before. Now that we’re in a slow market, it’s the perfect moment for you to not only hedge your bets on some upside, but also start farming an airdrop that’s still going under the radar.

Yeah, we’re talking about Hylo here.

Hylo.so provides leverage and stablecoin services to users, offering a chance to accrue value through a series of means.

For today’s article, we’ll be looking at two of their products, hyUSD and xSOL.

HyUSD

Here’s what we know: Hylo’s stablecoin allows you to store value, and is pegged to the US Dollar like most stable coins. A few weeks ago, they hit the $100 million mark in TVL. October 25th, to be specific.

While not as known as other stables, it comes with its own set of perks and rewards, just for holding it which we will see later, but this is also a good reminder to keep your options spread when the markets take a turn for the better, alright?

xSOL

xSOL is essentially a tokenized form of leveraged long exposure to SOL. By holding the token, you’re basically going long on SOL.

Rather than trying on margin, borrowing or external oracles like other ways to leverage, xSOL functions as a synthetic asset whose leverage emerges from Hylo’s dual-token architecture. So hyUSD and xSOL go together, but how?

xSOL is the risk, why hyUSD serves as the stable. Together, both assets draw from a shared collateral pool made up of diversified liquid-staking tokens (LSTs) such as mSOL, jitoSOL, and bSOL. These LSTs generate native staking yields–typically 7-8% APY–that continually accumulate into the pool, strengthening collateralization and supporting system stability.

Because xSOL is part of this structure, think of it as symbiosis with hyUSD, (or at least that’s what it makes it stick over here) and holders gain amplified exposure to SOL’s upside (price gains) while avoiding traditional leverage hazards like liquidation thresholds or funding-rate bleed.

So you never get closed out, just have your xSOL reduce as the market goes against SOL, and then increase when SOL’s gaining ground. All based on the pool’s net asset value (NAV) accounting.

Minting and Redemption

xSOL is minted directly against Hylo’s collateral pool. Users deposit LSTs or Stables and the protocol issues xSOL using an internal NAV model, ensuring slippage-free minting.

One trick is to just swap from a stable to xSOL from Jup.ag or any dex you currently use if you’re the type looking to build a long term position.

Another entry path is to mint hyUSD first at a strict 1:1 rate against deposited collateral, then swap hyUSD for xSOL through Hylo’s liquidity layer.

Redemption is equally straightforward. Burning xSOL returns a proportional share of the underlying LST collateral, again without slippage, preserving permissionless two-way convertibility. Importantly, minting xSOL does not create separate, leveraged accounts: all xSOL holders mutually share the same collateral pool and volatility exposure.

Here’s a little bit of technical explanation for those who love it, if you don’t care too much for things like this, then you can skip it just a little bit.

The Volatility Absorption Mechanism

xSOL’s leverage arises from Hylo’s volatility absorption mechanism, a system that keeps hyUSD pegged while channeling collateral value fluctuations into xSOL. The system maintains the following invariant:

Collateral TVL = (hyUSD Supply × $1) + (xSOL Supply × xSOL Price)

Thus:

xSOL Price = (Collateral TVL − hyUSD Supply) / xSOL Supply

This “variable reserve” is the excess collateral after guaranteeing hyUSD’s peg. When SOL appreciates, the collateral pool grows, increasing the variable reserve and pushing xSOL’s price up by a larger percentage than SOL’s move. When SOL declines, the reserve contracts and xSOL absorbs that downside, protecting hyUSD. xSOL holders therefore experience magnified gains and losses while never facing liquidation.

Example Dynamics

Take an initial state where $100 of SOL collateral backs $50 hyUSD and $50 of xSOL (50 tokens at $1 each). The system’s effective leverage here is 2×. A 10% rise in SOL increases the collateral to $110, raising xSOL’s price to $1.20 (+20%). Likewise, a 10% drop reduces collateral to $90 and xSOL to $0.80 (−20%). If more hyUSD enters the system—say, an additional $50 minted—the effective leverage on existing xSOL increases, because the same xSOL market cap must now absorb volatility across a larger collateral base.

Leverage, Risks, and Yields

xSOL’s leverage is dynamic, typically 2–4× depending on hyUSD demand. There are no liquidation risks, but holders face volatility decay in choppy markets, as repeated up/down cycles erode the variable reserve. Other risks include LST depegging or smart-contract vulnerabilities.

While staking yields accrue primarily to hyUSD stakers (via sHYUSD), the collateral pool’s growth indirectly benefits xSOL by increasing TVL. xSOL can also be traded on DEXs such as Jupiter for added liquidity.

For long-term SOL bulls seeking passive, perpetual leverage without margin management, xSOL offers a streamlined alternative—amplifying SOL upside while minimizing operational complexity.

And now on to the XP points system:

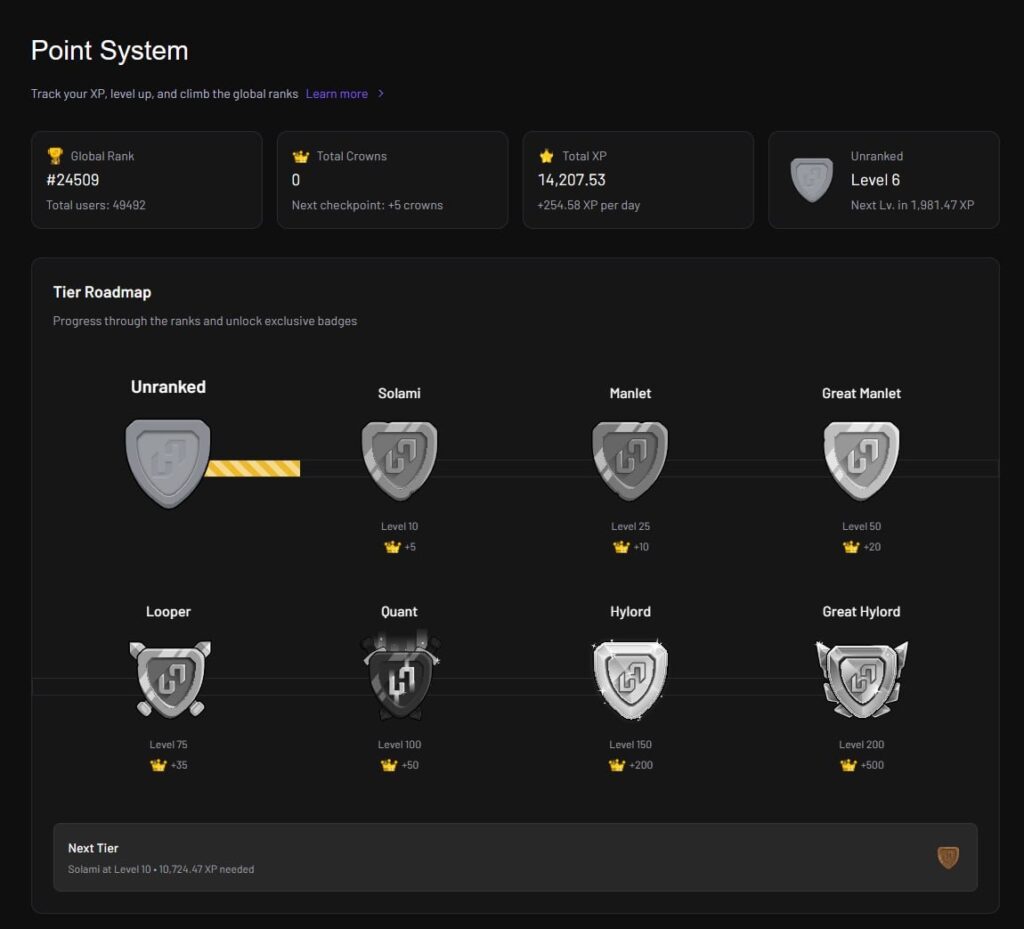

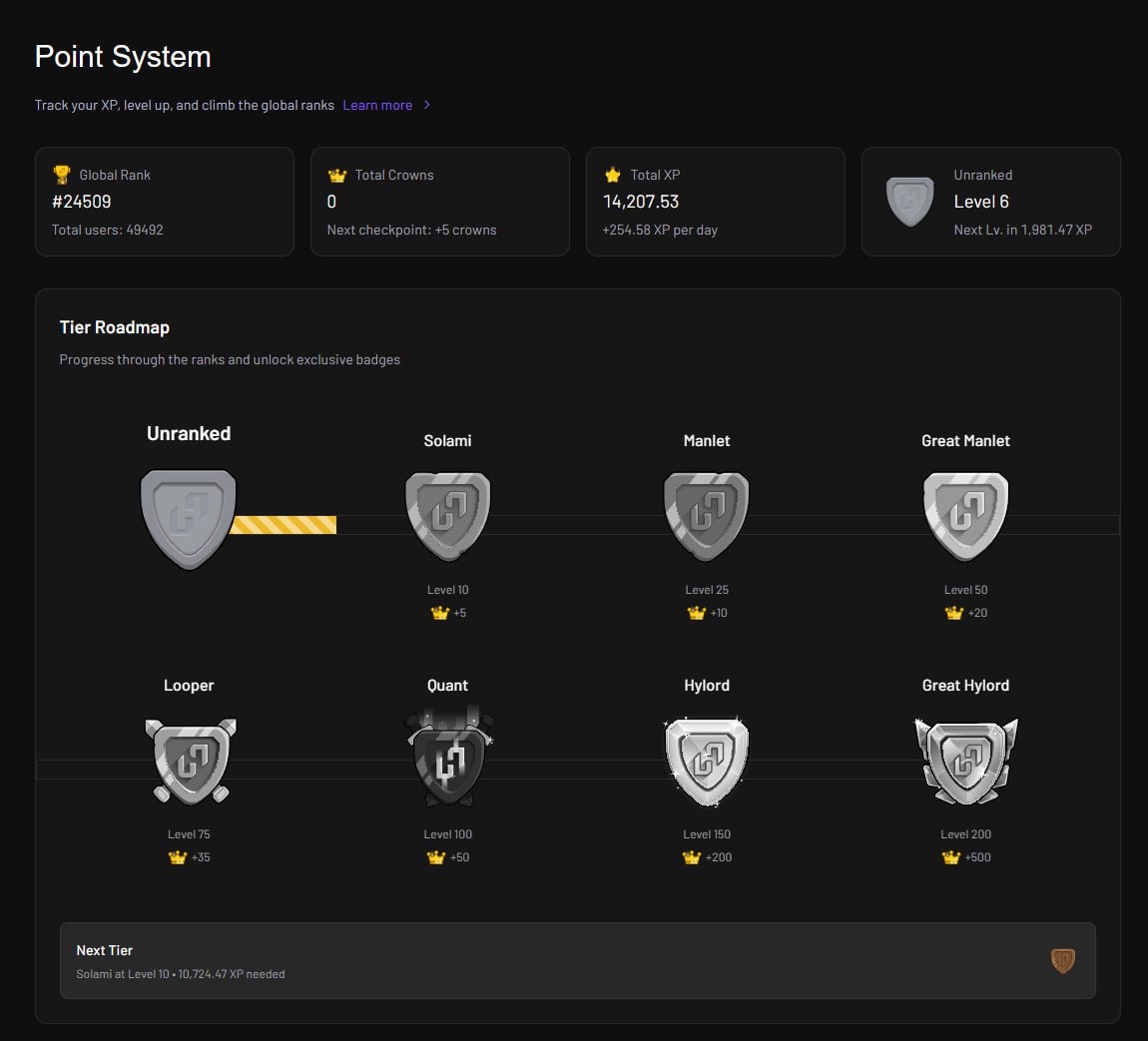

Hylo XP Points System

Hylo’s Season 0 airdrop campaign uses an on-chain XP system that rewards early participation across its products, primarily hyUSD and xSOL.

Users will earn XP based on asset value and holding duration, positioning themselves for a future governance/utility token airdrop (estimated to be around ~$1.75M).

While no token is confirmed, XP standings in the on-site XP Hub and leaderboard will directly influence allocations. The system prioritizes consistent holding, offering base rates of 1 XP per dollar per day, multiplied by product-specific boosts—xSOL earns the highest multiplier at x20.

Temporary “Flash Boosts” (e.g., 2× or 4× across all assets), partner-specific multipliers, and referrals (10% of a friend’s XP) can significantly increase earnings. As XP accumulates, users ascend tiers from Level 1 “Solami” to Level 200 “Great Hylord,” unlocking symbolic crowns that may carry future utility.

hyUSD holders earn x5 XP daily per dollar (or x1 when staked as sHYUSD, which trades XP for higher APY). Integrations such as Kamino LPs or Project0 can amplify XP further.

xSOL offers x20 XP per dollar per day, reflecting its leveraged risk profile. Boosts via Loopscale, Exponent, or Flash events can push earnings dramatically higher.

XP is path-dependent—holding beats trading—and rewards align with supporting Hylo’s stablecoin and leverage ecosystem.

Here’s a breakdown of the tiers and points you need to assure yourself of an airdrop, but that’s only if you are interested in farming an airdrop that requires you to do nothing but hold!

So, you up to this, Cypher?

Leave a Reply