Perp trading on Solana has exploded this year. With sub-second finality and near-zero fees, Solana finally has the infrastructure to rival CEX-style derivatives trading — but with on-chain custody and DeFi composability. Neat, right?

For traders, the question isn’t “should I use Solana perps?” It’s which venue and what platform fits my style.

Wanna know more? Let’s dive in!

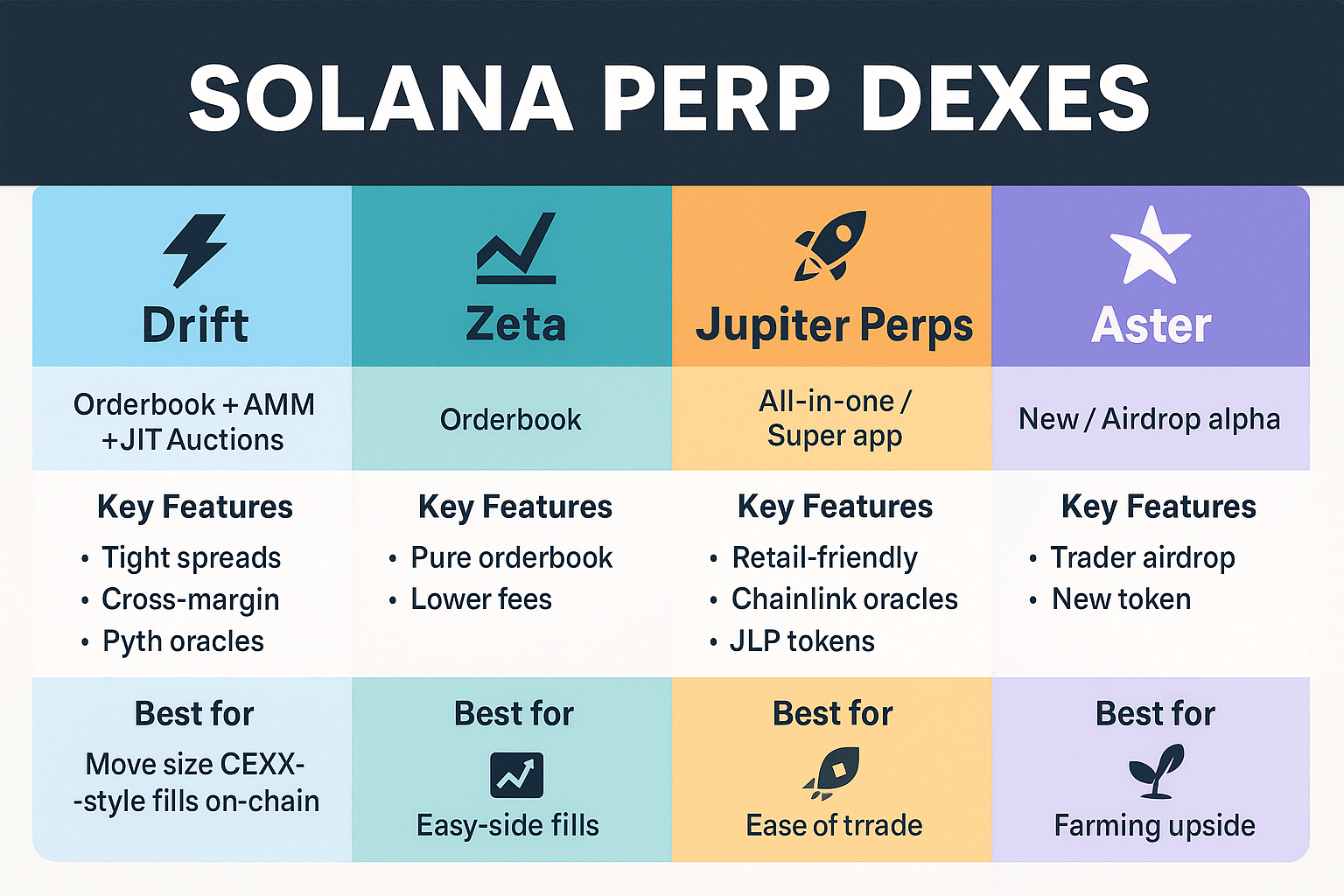

⚡ Drift — CEX-like Fills with On-Chain Finality

- How it works: Hybrid design — orderbook + AMM + Just-in-Time (JIT) liquidity auctions. Market makers compete in real time to fill your order, often improving your execution vs a static AMM.

- Why does it matter?:

- Tight spreads for market takers.

- Cross-margin engine for efficiency.

- Integrates with Pyth oracles for low-latency pricing.

- You can trade directly inside telegram courtesy of their integration with our bot, SolCypher allowing you to handle your trades from any device in the world.

- Tight spreads for market takers.

- Best for: Traders who move size or scalp quickly and want CEX-quality fills without leaving Solana.

📉 Zeta Markets — Pure Orderbook Perps

- How this works: As a traditional on-chain orderbook. Think CEX execution, but on Solana rails.

- Why it matters:

- It has a clean, familiar perp trading flow.

- Lower fees for active traders.

- It has a clean, familiar perp trading flow.

- Best for: Traders who just want a no-nonsense orderbook and tight fees.

📲 Jupiter Perps — The “All-in-One” Option

- How it works: This perps options offers features built inside the Jupiter super app (which supports swaps, launches, lending). Uses Chainlink Data Streams for pricing and offers JLP tokens for LP exposure.

- Why it matters:

- Everything in one place: swap spot, farm yields, and trade perps without switching apps.

- Retail-friendly UI + mobile support.

- Everything in one place: swap spot, farm yields, and trade perps without switching apps.

- Best for: Casual or mid-sized traders who already live inside Jupiter.

🚀 Aster — The New Challenger (and Airdrop Alpha)

- What’s happening: Aster has been surging in trader chatter as a fresh Solana perp DEX challenger. Buzz is building around their upcoming airdrop for active traders, with eligibility tied to trading activity and volume.

- Why it matters:

- New DEX = higher incentive programs, more aggressive fee rebates.

- Early users usually get the biggest cut of airdrops, and it’s shaping up to be a huge one.

- New DEX = higher incentive programs, more aggressive fee rebates.

- Best for: Degens and early adopters who don’t mind smaller liquidity today in exchange for farming tomorrow’s upside.

🔑 Key Takeaways for Traders

- Move size with Drift → JIT auctions = better fills, plus cross-margin. Trade with comfort and speed. (No need for a monitor)

- Stick to orderbooks with Zeta → Simple, efficient, CEX-like execution.

- One-stop shop with Jupiter → Easy if you’re already swapping/farming there.

- Farm the future with Aster → Trade now, position for the airdrop.

⚠️ Risks to Watch

- Liquidations: Know how each platform handles margin calls and insurance.

- Oracles: Volatility can expose differences between Pyth (Drift) and Chainlink (Jupiter).

- Liquidity depth: Aster may offer rewards, but size takers risk slippage until volumes scale.

🎯 Bottom Line

Solana’s perp landscape is no longer one-size-fits-all. Drift, Zeta, and Jupiter give you established choices depending on style. Aster is the rising wildcard — smaller today, but with an incoming trader airdrop that could turn early adopters into winners.

For traders, the playbook is simple:

- Trade size → Drift.

- Keep it simple → Zeta.

- Stay in one app → Jupiter.

- Farm upside → Aster.

Leave a Reply