The next evolution of SolCypher’s community incentives is here.

Up till now, SolCypher’s bot offered buybacks to support selected partner tokens (like $WORTHLESS), funded by a slice of trading fees. Now, for the first time, buybacks are enabled for our native token: $CYPHER.

That means every trade doesn’t just generate volume — it builds direct demand for the token powering the platform.

What Are Buybacks, Really?

A buyback uses protocol revenue (fees collected in SOL/USDC) to purchase $CYPHER on the open market. Those purchased tokens can then be:

- 🔥 Burned — permanently reducing supply.

- 🏦 Sent to the Treasury — strengthening liquidity and runway.

- 💎 Distributed to Stakers — rewarding long-term holders.

Buybacks convert real usage into real demand — not speculation.

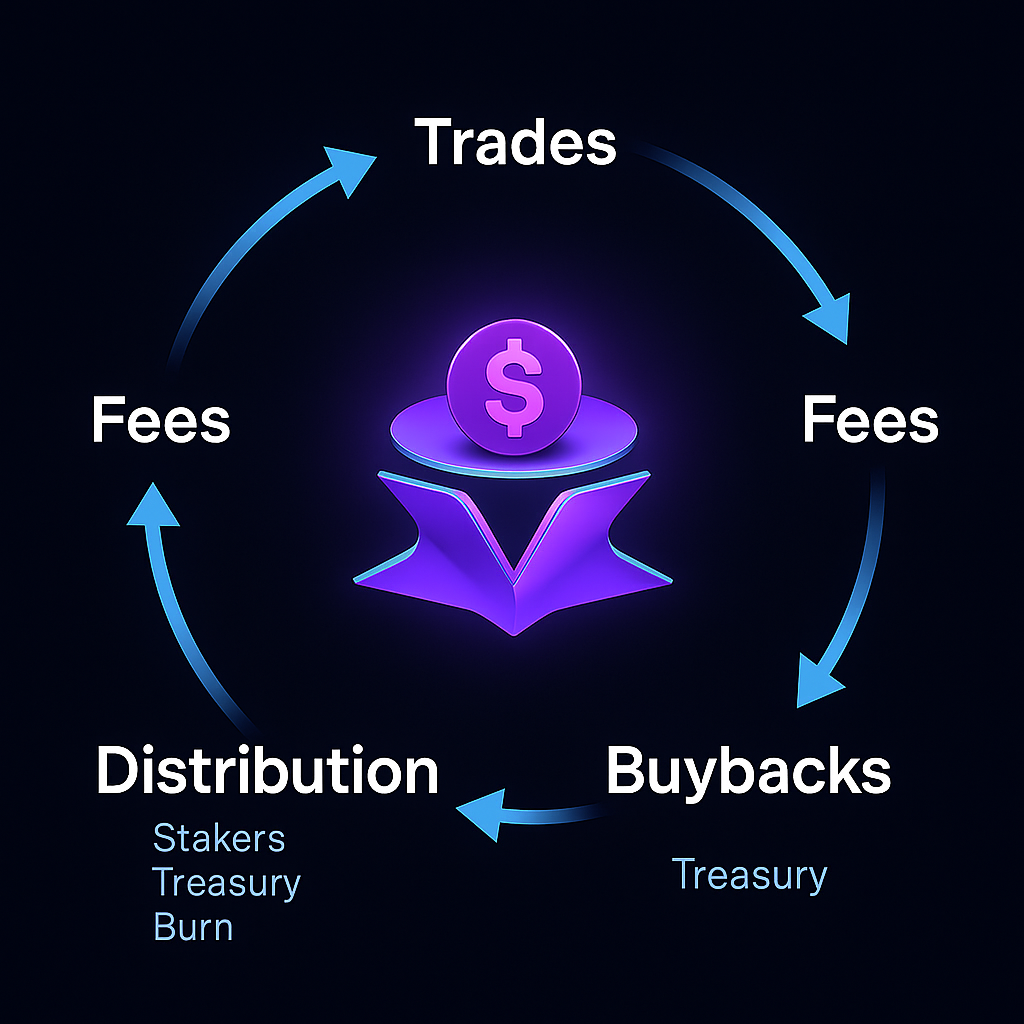

How SolCypher Buybacks Work

- 25% fees are accrued → Every eligible trade feeds the Buyback Vault.

- Allocation Switch → A percentage (e.g. 20%) is routed for buybacks.

- Execution → Buys happen on a schedule or when vaults hit thresholds, using TWAP to prevent front-running.

- Distribution → Tokens are burned, staked, or stored in treasury per current policy.

- Transparency → On-chain transactions and dashboards show everything.

“Dev, Token Go Up” — The Mechanics

Buybacks don’t magically pump. They create sustained net bids linked directly to trading activity.

Example:

- Monthly fees: 50,000 USDC

- 25% allocated → 12,500 USDC

- At $0.10 price → 100,000 $CYPHER bought

- Distribution policy: 50% stakers, 40% treasury, 10% burn

- 50,000 distributed to stakers

- 40,000 reserved in treasury

- 10,000 burned

- 50,000 distributed to stakers

As trading grows, so does buyback pressure. These are not actual figures and just an illustration.

Why This Matters

- 🧑💻 Traders → Every trade contributes to $CYPHER demand. The more traders see their fees go back to building the product, the more trust we can earn.

- 💎 Holders/Stakers → Earn yield from protocol activity.

- 🏗 Builders → Our treasury captures tokens for future development.

This aligns everyone — usage, community, and growth — in one flywheel.

Guardrails, Not Hype

- TWAP (Time Weighted Average Price) + randomized execution windows

- Caps & emergency pause switches

- Full public accounting (addresses + TX logs)

- Zero off-chain discretion

Get Involved Now

💹 Trade with SolCypher → Your activity fuels buybacks.

💎 Stake $CYPHER → Capture rewards from distribution.

📊 Track the Dashboard → Verify buys, watch burns, follow epochs.

In Internet Capital Markets, capital and customer retention is key. Buybacks ensure SolCypher turns activity into lasting value — for the product, the token, and the community.

Leave a Reply